*This post may have affiliate links, which means I may receive commissions if you choose to purchase through links I provide (at no extra cost to you). As an Amazon Associate I earn from qualifying purchases. Please read my disclaimer for additional details. Thank you for supporting the work I put into this site!

What is a zero-based budget? Zero-based budget implies that you will assign a name tag on each of your hard-earned pennies and when the month ends, you will have zero pennies left in your hands to spend. Every penny will be accounted for in one way or the other. Intriguing, isn’t it? Well, find out more here.

What Do You Mean By Zero-Based Budget?

The term ‘Zero-Based Budget’ can be quite confusing in and of itself. It simply refers to a system of budgeting where you can subtract your income from your expenditure and get zero. In other terms, it means that every one of your hard-earned pennies is being used to take care of your living cost.

Your income completely matches your expenditure. However, this does not mean that your bank balance is zero. Puzzled? Here’s an example:

Suppose you earn $5000 per month. You would want all of your savings, investments, and expenditures accounted for in this $5000. If you do this, you will know the whereabouts of each and every penny.

This is important because if you do not know where all your money is being spent, you are preparing for financial disaster. It’s no joke to realize that your bank balance is zero and you have no idea where the money went.

Steps To Prepare a Zero-Based Budget

Account Your Monthly Income

The first step is to compute your total monthly income either in a notebook or app. Your total income comprises your paycheck, residual income, child support, and income from small-businesses and others. Any money that gets credited in your account forms your income. The sum of all your incomes equals your budget.

In addition, do not forget to account for your savings while preparing your budget. The sole art behind money-saving magic is making priorities and then sticking to them. It is important to prioritize saving money in your life early on, so that it becomes a natural habit.

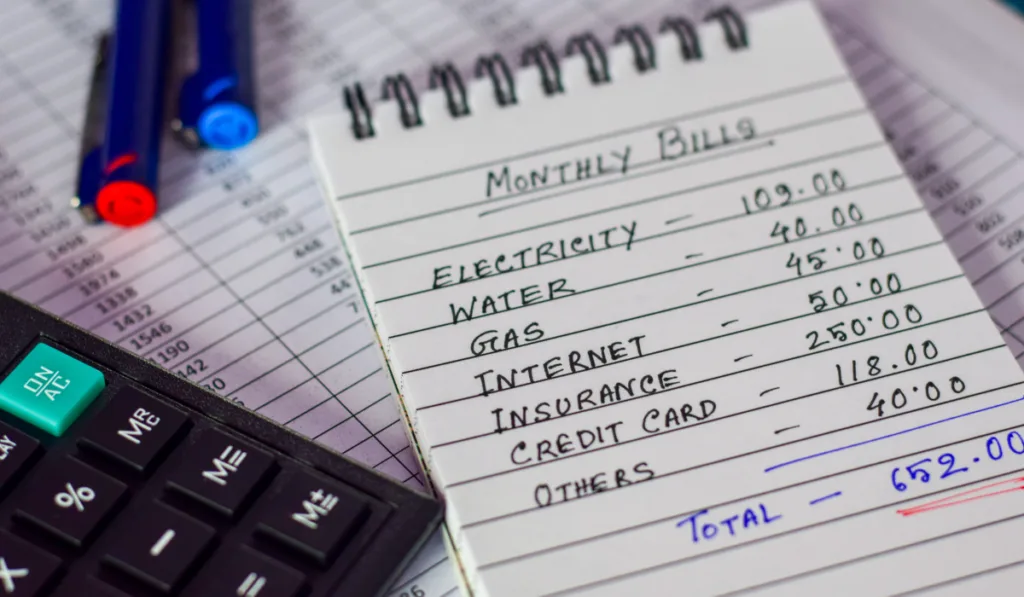

Compute Your Monthly Expenses

When a month starts, make a note of your expenses under all the headings such as rent, electricity, food, cable and everything else that will make up your expenditures.

Prioritizing your expenses is an equally important step. The Four Walls, i.e. food, basic clothing, shelter, utilities and transport should get the maximum priority in your list.

After you have accounted for the bare essentials, other expenses should be listed. As the calendar changes, your needs will change. Therefore, it is important to make a new spending plan each month. It might seem overwhelming at first, however, in the long run, it will prove beneficial.

This small practice will act as an umbrella in your rainy days and protect you from going bankrupt. In the beginning, try focusing only on one month at a time and the process will not be as overwhelming for you.

Compute Your Seasonal Expenses

When your daily expenses have been accounted for, study the calendar and start making plans for seasonal holidays. This way your pockets stay comfortable even during the holidays. It is important to ensure that you are prepared for the holidays much in advance. Occasions such as birthdays, anniversaries, and festivals are not surprises and need to be planned in advance.

Also, you must plan for surprise expenses that may hit you out of the blue. If you stash some cash away every month for emergency expenses, you will never have to panic about money.

Subtract your Income From Expenses to Get Zero

Your main aim is to obtain zero but it will take a little practice to successfully reach that number. Don’t lose hope when you fail to achieve the desired goals in the initial months. Learn from your experiences and tweak your spending and saving habits in such a way that you finally get to see the magnificent zero in your balance sheet.

If you notice that your expenditures are more than your income and your savings are depleting every day, it is time to make some necessary cut backs. Stop yourself from extravagance and try to keep a check on your desires. Desires have no limit, whereas your budget does.

You can also shop at stores that offer discounts, cut off the cable, use public transport or carpool, buy generics at grocery stores, etc. You can also start some side business to boost your income like freelancing or even sell stuff to make some quick cash.

On the other hand, when you have some surplus money left after taking everything into account, you must put a tag on it too. It is totally your decision where you want it routed; into the expenditure department or into savings, but it is necessary to account for it somewhere. This is because if you fail to do so, you will lose track of that money. Nobody wants to lose money.

Keep on Track and Get Going!

The only thing remaining is to keep an eye on your expenses and savings all throughout the month. It will keep you updated whether or not you are sticking to your budgetary plan. Eventually, with practice and dedication, you will observe a change in your money managing habits.

Your spending habits will improve, you will see an increase in savings, and you will achieve an overall budgetary victory. You will have surplus money to spend all year round. When you make it a habit to keep a tab on each of your pennies and engage with it regularly, you will start making progress and begin enjoying your life to the fullest sans the bank balance stress.

Irregular Income and Zero-Based Budget

Even if you do not have a regular source of income, you can make use of zero-based budgeting method. The golden rule here is to center your budget on your minimum income.

While distributing money under different headings, cover the Four Walls first and then prioritize your expenses. When your income is more, fill up the deficiencies in different departments and you will get back on track.

Importance of Zero-Based Budget

It is extremely important to follow a budget if you wish to achieve your money goals, even if you are a billionaire. By making use of a zero-based budget, you become the boss of your pennies and tell them exactly where they need to go. And honestly, who doesn’t like to be a boss?

So, adopt the zero-based budget today and live your life to the fullest!